Let’s see. We have federal budgets wildly out of balance and a staggering national debt. And a plan is already in place to cut the budget more significantly than ever. So the problem is…what?

It’s been said before, but it must be said again. Washington does not have a revenue problem. It has a spending addiction. And the deal to temporarily avoid the potentially catastrophic consequences of the fiscal cliff not only does nothing to address it, it deepens the addiction.

The agreement obviously works for the left because they view higher tax rates for the rich not as a means but an end in itself, though it also helps as a means of justifying their other desired end – ever-increasing government control.

The deal includes more than $600,000,000,000 in tax increases that will likely slow down a recovering economy, and virtually zero spending cuts, thus accomplishing again what Congress does best – postponing the most important debate, the one on spending in general and entitlements in particular.

But the best possible spending deal is already in place.

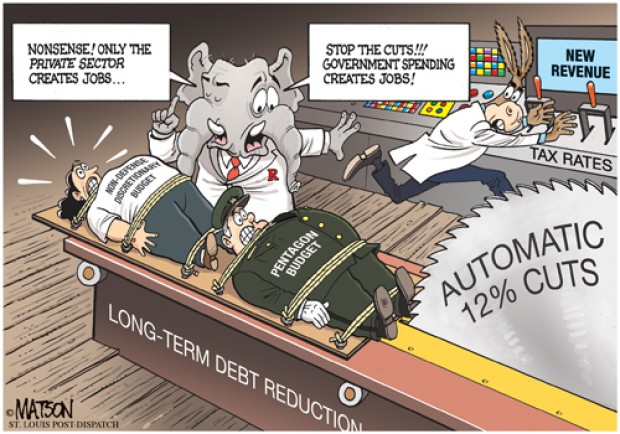

The dreaded sequester, with its $1,200,000,000,000 in automatic spending reductions, was kicked down the road for a couple of months in the tax deal, but it actually includes the framework for a deal within its very parameters, as it was specifically designed to force both sides to split the pain by cutting the type of spending that’s important to each side – domestic for the left and defense for the right. Of course, it was also designed to dish out so much pain that neither side would be willing to let it stand. But that was then and this is now.

With the national debt continuing to mount unabated at a frightening pace, here is what our message should be to the ruling class:

If you’re serious about actually reducing the size of government – a proposition about which we should have grave reservations – then take the sequester. Just swallow it. After all, who believes any spending deal made before we hit code red again in two months (the next episode in the debt ceiling debacle that dominated the summer of ‘11) will really attack the problem?

When combined with this deal on taxes, what we would almost certainly wind up with in almost any deal from here on in is the typical bottom line out of Washington. As all the tax increases happen immediately, the spending cuts are spread out over many years, and are thus fully revocable by future congresses. And the typical excuse will be used: if we cut spending too fast, it could throw the economy back into recession.

Nonsense. The markets and private economy (except for beltway bandits and others feeding at the public trough) will almost certainly respond positively to the first serious move by congress to stanch the bleeding brought on by consistently spending a trillion dollars more than we collect, borrowing promiscuously and passing the bill on to future generations.

But there is a simpler way to frame the ultimate question about cutting the federal behemoth down to size: if not now, when? When exactly will the politicians agree that it’s a good time to reduce the jobs and goodies dished out by the federal government?

We already got one largely overlooked feature of the tax deal that will help a bit – the end of a payroll tax holiday which turned into a sabbatical. Payroll taxes are used to fund entitlement programs and thus should be viewed less as taxes than as premiums, much like you pay for life, health or car insurance. And in a nation already bathing in red ink which nevertheless voted to change nothing in the last election, the last thing we can afford is to restrict the flow of revenues to budget-busting programs people are loathe to even consider restructuring.

Another common argument is that the across-the-board approach called for in the sequester – 10% cuts to defense and domestic discretionary programs – is not the right way to reduce spending, that effective reductions must center around cutting unnecessary and inefficient spending while retaining programs that have proven necessary and effective. Nice thought, but do you really believe the ruling class has demonstrated the will to do so? Not even close.

As those in the private sector know, across the board is the most common method used for reducing budgets. Sharing the pain is a time-tested way of successfully enforcing hard change. Everyone complains, but complies.

For those on the right who object to the automatic cuts to defense, it is certainly important to consider whether the cuts will ultimately hamper our military preparedness. While Secretary of Defense Leon Panetta has said the cuts would be devastating – protecting his turf as he and his DC colleagues do so well – his predecessor Robert Gates, who has added credibility because he served in that role for both Presidents Obama and Bush, was clear that there is much fat that should be cut from the Pentagon. Perhaps hundreds of billions of dollars worth. He said the layers of fat actually hamper our strength and preparedness. Remember that the Defense Department is a bureaucracy like all the others in Washington. And we can not realistically expect it alone to avoid the hatchet or scalpel.

Of course, there is a much larger factor at play here. As therapists will tell you, before you can try and solve a problem, you must first admit there is a problem and take responsibility. Is it just me, or do you get the sense that the congress is not exactly willing to admit its addiction?

It is still unlikely that the sequester will be allowed to happen. And it is likely that another Washington deal that fails to seriously address the problem will take shape. But one day, we may well look back on this not for the deal that was cut, but for the opportunity that was missed.